TWS #033: Is Apple floundering?; Are you a maker or taker?; Softbank unloads $$$ on Nvidia

+ DD: Garmin's strategic comeback, the rise of prediction markets, and spatial intelligence

Every week, get the latest curated signals on news, insights, and strategic analysis from the best companies in the world and its people to help you become a better builder. Paid subscribers get full access to all newsletters, deep-dives, fields guides, and curated podcast Q&A notes.

Please fill out our survey so we can deliver the best content to you. 48% of our readers are not subscribed, so if you like the content, consider subscribing.

👋 there. Welcome to another TWS edition from Alpha Bytes—the newsletter that gives you curated insights on technology innovation, breakthroughs, and business so you can make better decisions to prepare you for tomorrow.

Here’s what we got for you today:

🏆 Upcoming deep dive: Garmin’s interesting comeback

👉 Apple is using Google’s Gemini to power Siri

👉 Can Apple build humanoids (and do they want to)

👉 Softbank unloads $$$ from Nvidia (for good reason)

👉 Why Google is partnering up with prediction markets

✍️ Essay: Are you a Producer or a Consumer?

🏆 Garmin: Inside the strategy that brought a legacy brand back from near death

🎁 Full drop lands this Sunday, November 16, at 10 am Pacific Time

🤩 This will be a free edition! We do this occasionally to share free insights. However, please consider becoming a paid subscriber to get access to the full content across our newsletters, deep dives, and field guides.

What readers got last week:

Other readings you might like:

See you next week.

🔥 Weekly Signals

Apple is going to use Google’s Gemini to power its new Siri —

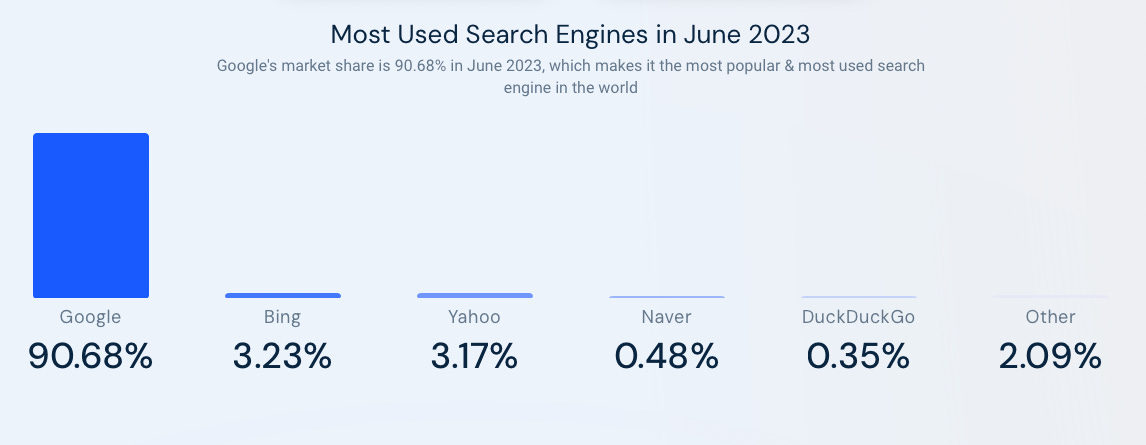

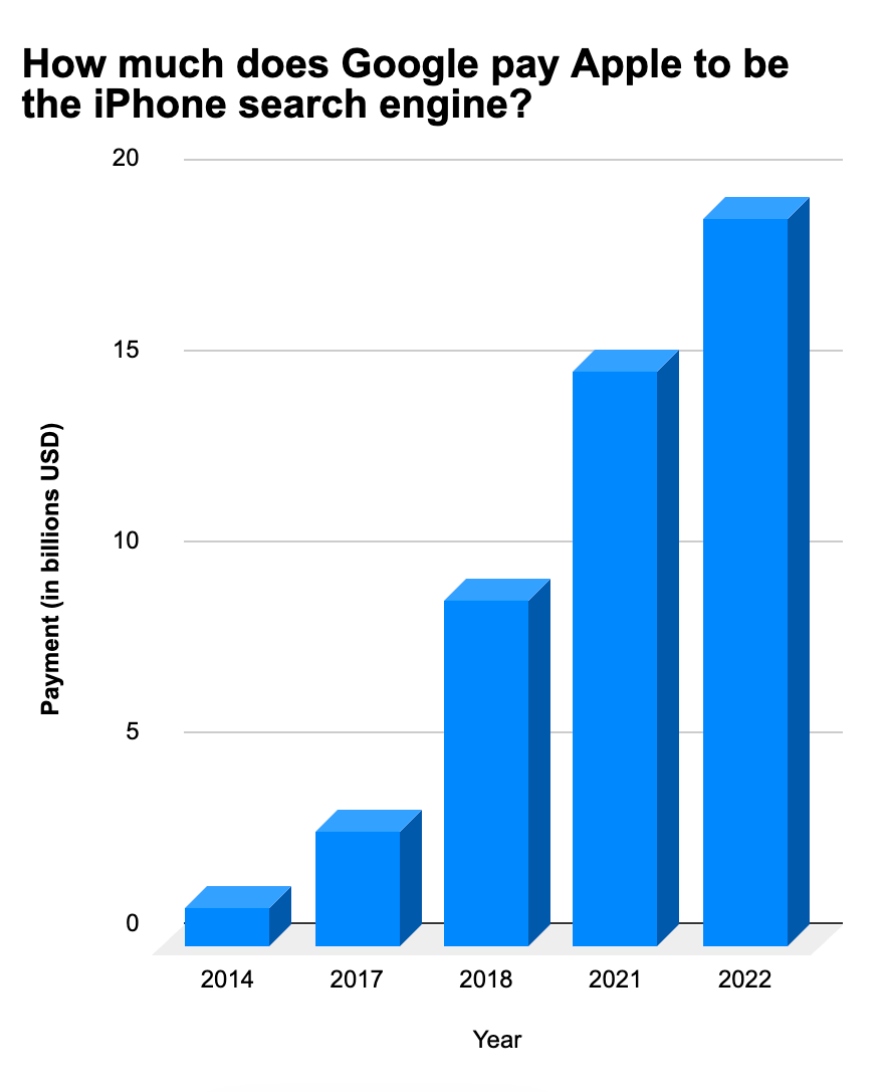

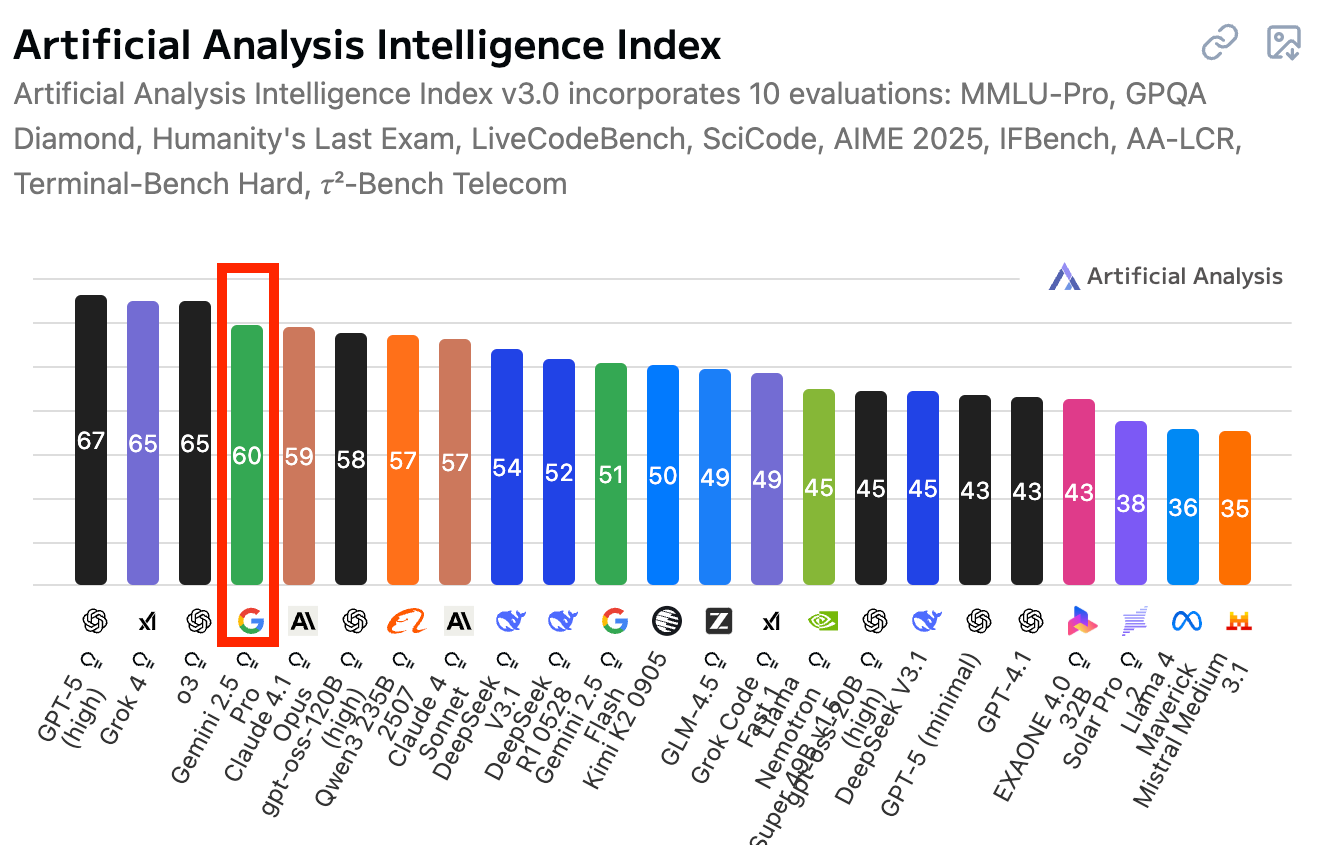

I think Apple has finally realized their flawed in-house strategy isn’t really working and is now scrambling. The plan is for Apple to use a custom Gemini model to overhaul Siri, paying about $1 billion per year. The model apparently has 1.2 trillion parameters, far larger than Apple’s current 150 billion-parameter cloud model, and is intended as a temporary solution while Apple builds out its own AI. Apple tested models from OpenAI and Anthropic but chose to proceed with Google. Also, while Apple will pay Google $1B/year for the model, Google is paying around ~$20B for allowing Google to be the default search engine on the iPhone.

Most likely, the Apple-Google Gemini model will be closed source and might have some in-built restrictions and limits applied to it. The last thing Google wants is Apple to steal/copy trade secrets. Just goes to show how dependent these companies are on each other. I think this is a good thing. The fact that Apple is willing to partner with “competitors” shows a sign that being a lone wolf doesn’t work anymore. AI seems to be a glue that creates strong interdependencies between these players. More of this will happen. [LINK]

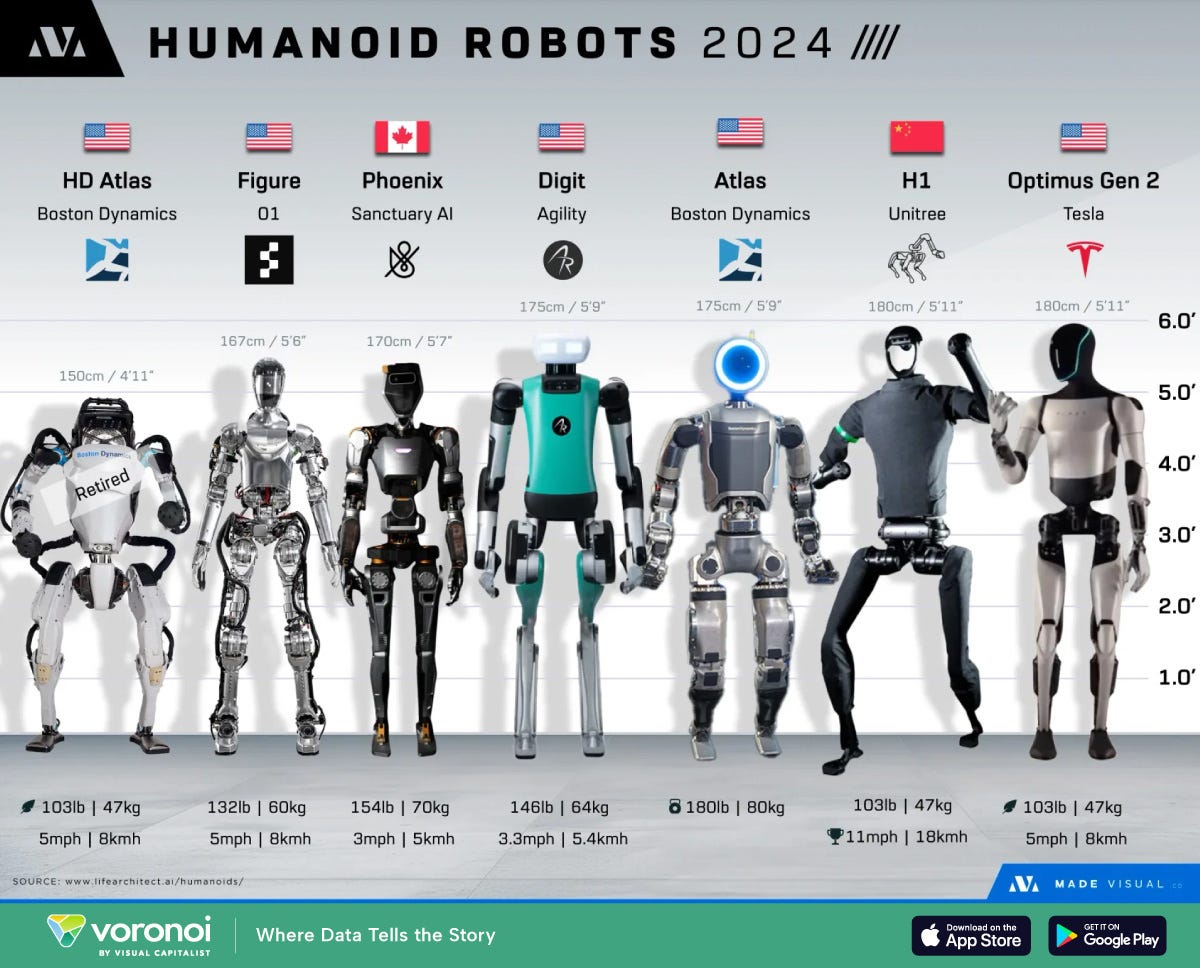

Apple could earn around $130–133 billion annually from humanoid robots by 2040 —

This would be such a bad ass move if they executed on this. Apple could potentially leverage its massive consumer base and monetize both hardware and services.

There’s already so much happening in space (Nvidia, Tesla, Figure, etc.), and if you’re Apple, the last thing you want is to fall behind (again) on this wave as they did with LLMs. Also, I think this would be the perfect opportunity to redeem themselves. Plus, they already have the manufacturing, hardware, and software infrastructure in place…so why not? Overall, these moves reflect a race to build general‑purpose robots capable of dynamic movement and task flexibility across different environments.

I also feel like the one thing holding Apple back on this is risk-taking. It feels to me they’re resting too much on their laurels and not taking enough big bets on the future.

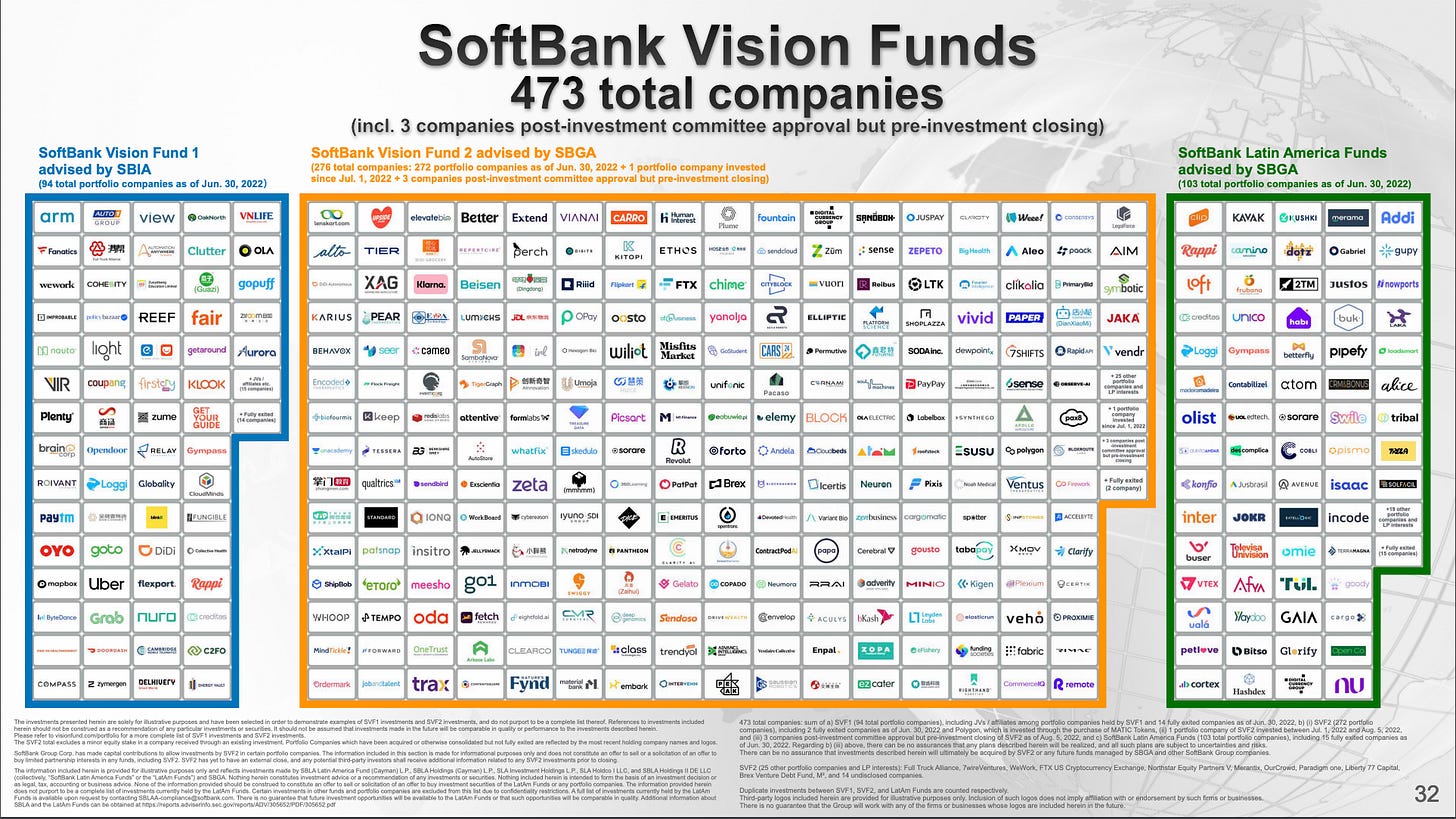

SoftBank sold its entire Nvidia stake for $5.8 billion —

Interesting that SB exited Nvidia after building a roughly $3 billion position by March. Founder Masayoshi Son is reallocating capital toward funding the Stargate Project with OpenAI and Oracle, including other AI bets.

Most people think this is a retreat from AI, but it’s simply a reallocation of capital towards other projects. I think moving from Nvidia stocks into OpenAI (which is a private company) tightens SB’s exposure to AI’s application and infrastructure layers. If OpenAI’s compute demands compound, SoftBank could own more of the value chain, even without holding Nvidia shares. [LINK]

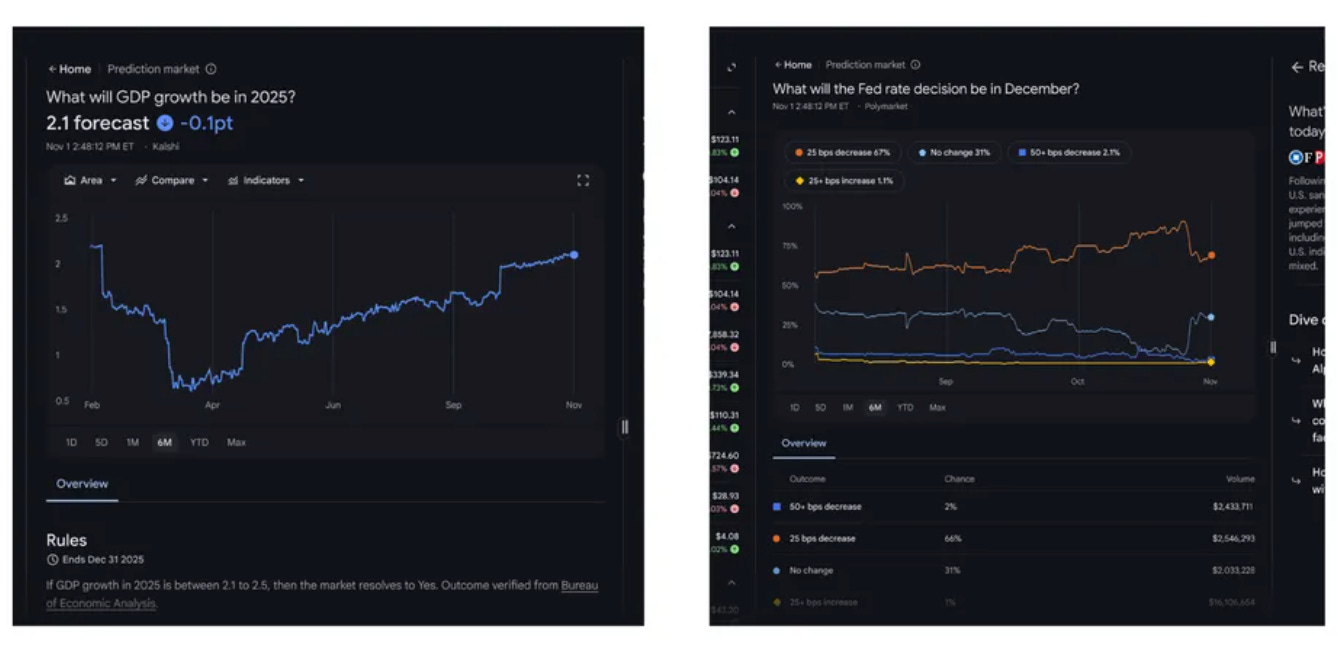

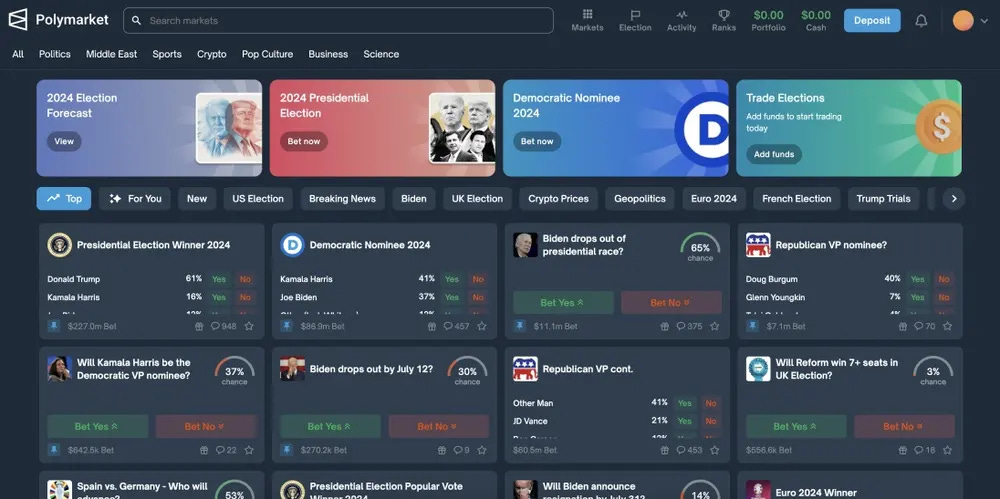

Google is partnering up with prediction markets like Kalshi and Polymarket —

Google Finance now offers an AI-powered experience to help users research markets, analyze charts, and track news in real time. The upgrades include Deep Search for complex financial questions that run extensive searches and return cited, comprehensive answers. The integration with prediction markets allows you to ask market-even questions (e.g., GDP growth in 2025, etc.) and view the probabilities.

I think the move to fold Deep Search into Finance is pretty interesting. It’s going to challenge a few startups in this space, like Quartr and Fiscal.ai, already doing this. Also, working with prediction markets means it will bring crowd odds into mainstream finance UX, which could shape macro events—but also tempt users to anchor on probabilities that are volatile, thinly traded, and maybe sometimes reflexive.

Side note: Polymarket has really taken off. They’re a fast-growing, blockchain-based prediction market, now valued at around $8B, expanding toward U.S. reentry. Their platform has seen crazy growth on the back of election and sports markets, positioning itself as a leading venue for crowd‑priced probabilities. [LINK]

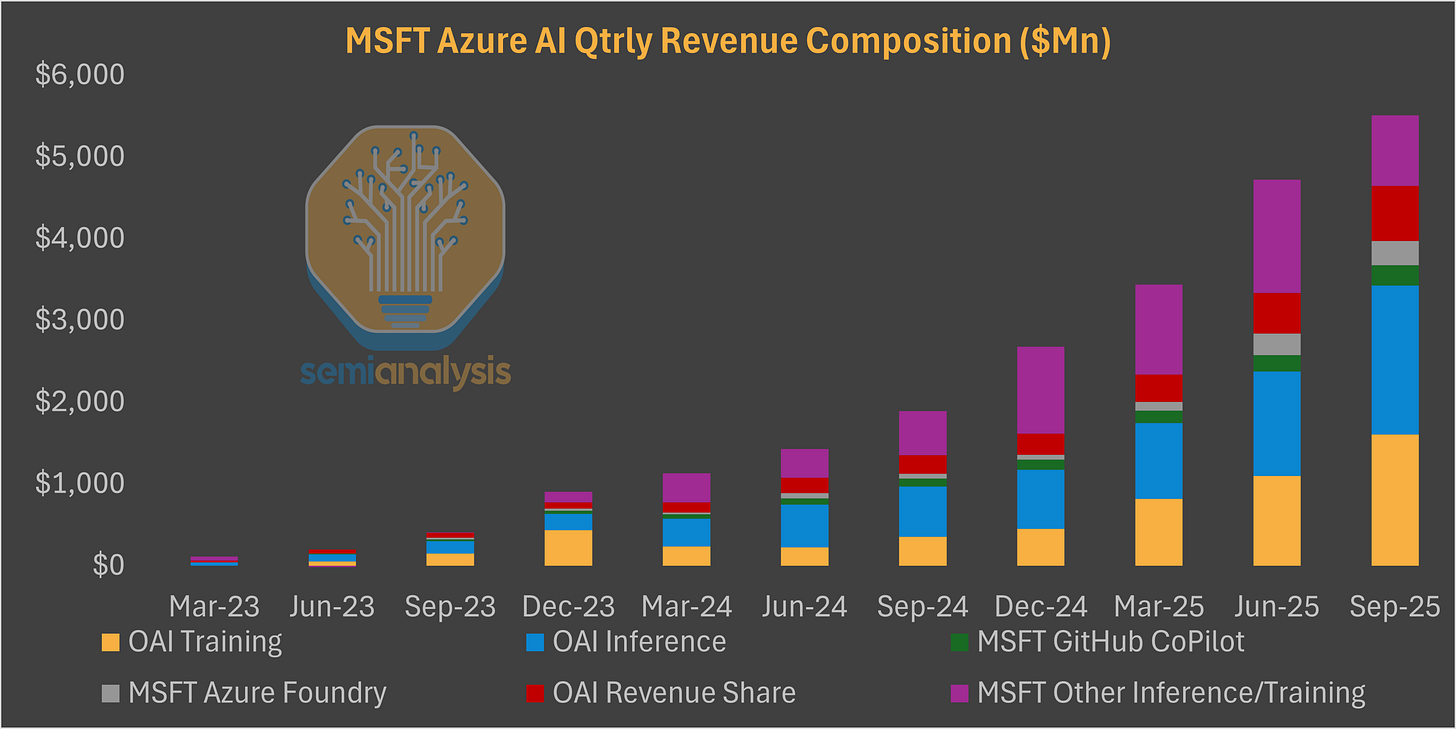

Microsoft’s Quarterly Rev is being driven by OpenAI —

It’s crazy to see how Microsoft is just milking OpenAI — quite the strategic move. OAI relies heavily on Azure’s infrastructure to help train its models. And it’s continuing to rise. This is probably why OAI is banking on Project Stargate (partnering up with Nvidia, Softbank, and Oracle) to break free from the MS handcuffs.

Read the full piece from SemiAnalysis. [LINK]

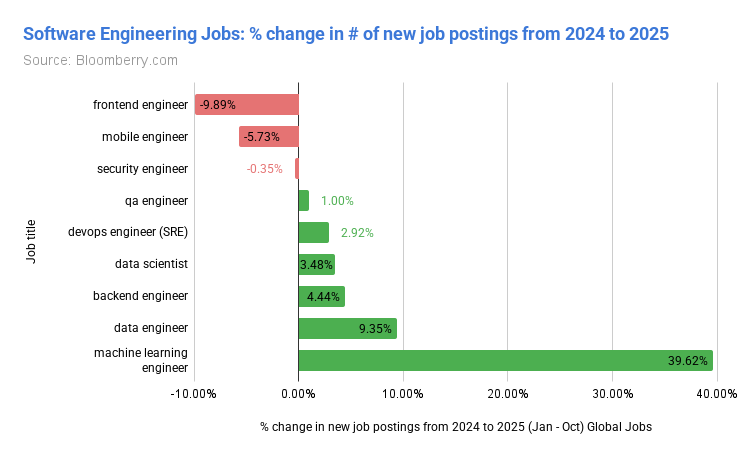

Be a Machine Learning Engineer

Well, at least for now…AI is shaking up this industry big time. The rise of ML engineers indicates that AI is immensely helping with productivity and not replacing them. You’ll need more ML folks to continue to understand and integrate with the latest models and bridge the LLMs with the application layers. This is going to be really important.

On the flipside, tools like Replit, Bolt, and Lovable have really upended the Frontend engineers. This might get worse as UI/UX tools are becoming exceedingly proficient in this area. [LINK]

Thanks for reading so far.

If you liked the content so far, you can check out our full TWS archive, plus more in-depth content: under the hood and field guides.

If you’re a founder, apply here (Metagrove Ventures) for funding.

I’d love to get some feedback. If you have some time, fill out the following survey.

Want to get in front of our audience? You can partner with us.

Upgrade to the premium version for full access to all content.

Follow me on LinkedIn or X for more insights.🍿 Quick Bites

From Words to Worlds: Spatial Intelligence is AI’s Next Frontier. Fei-Fei Li gives her take on why spatial models are the next big thing. Spatial intelligence links perception and action, enabling machines to reason about geometry, physics, and dynamics, not just describe them. [a16z]

Data and Defensibility. Data is the new moat, and I think most founders and leaders don’t think enough about the value of their data. This piece helps you become more aware of what you’re leaving on the table and how to prepare for a world where data makes you stand out from the rest. [Abraham Thomas]

Inside Cursor — Sixty days with the AI coding decacorn. A candid inside look at Cursor’s culture, recruiting, and product rituals—and why they win. [Colossus]

The ElevenLabs Story — Where you build is who you are. Shows how unique origins, global teams, and pragmatic product decisions build trust and scale in AI. [a16z]

“ElevenLabs wouldn’t exist if they weren’t based in Europe. In Poland, where much of the original team is from, all foreign films are dubbed with one actor, who performs lines in monotone for both genders (I personally felt this pain too growing up in China, but at least the production teams responsible for dubbing splurged for two actors!). This frustration partially led to the recognition that the world needed a strong text-to-speech offering.”

✍️ Essay

Producers vs. Consumers

I spent an hour (and maybe more) last night on my phone, and I can’t tell you a single thing I learned or really remembered from that hour.

I was in that very familiar “doom-scroll-state”, you know, that hypnotic trance of 100% consumption—fully locked in. And yes, I should know better. I was switching between X, Substack, YouTube, Instagram, and even Strava and checking out all the posts, lives, shorts, and clips of just random crap.

I went to bed feeling full, but not satisfied. It was a feeling I think we all know too well.

This whole experience got me thinking about a simple, fundamental divide in our world: the one between the producers and the consumers. The makers and the takers.

From the moment we’re born, we are all consumers. We need food, water, warmth, and love. These are non-negotiable inputs. Our educational system, for the most part, continues this programming. It’s basically a 20th-century model built to create efficient employees. We were taught to sit down, be quiet, and consume a curriculum. The test was to see if we could repeat the information back. We were being trained for an assembly line, even if it was a white-collar one.

But at some point, a life of pure consumption starts to feel hollow. It becomes a detriment.

Keep reading with a 7-day free trial

Subscribe to Alpha Bytes to keep reading this post and get 7 days of free access to the full post archives.